Navigation: Basic Working Procedures > Pricing > Special Purpose Pricing > Discounting Methods >

Labor Discounts

|

Navigation: Basic Working Procedures > Pricing > Special Purpose Pricing > Discounting Methods > Labor Discounts |

|

Here we explain Labor Discounts, showing how to create Labor Rates that you can use for various Discounting Methods, for either the Company or your Customers.

TIP: Be sure to use short, meaningful names for these specialized margin entries, so that you can easily find them in Lookup Boxes.

Labor Rates are structured differently than Parts Markups. The only time that a Margin Markup is used is when the Rate Type is for the Tech Rate Markup. Since this is based on the Pay Rate (Company Cost per hour) for your Technician, you are automatically using Cost Basis here for any Margin Markup. In this case, the use of margin percents is similar to the Parts Discounts topic for examples using Cost Basis.

| 1. | zero (0%) = No-Charge |

| 2. | under 100% = Margin Discounts - note: under 100% of Cost is a loss |

| 3. | equals 100% = No-Markup |

| 4. | over 100% = Normal Margin Markup (and/or Discount, on Cost Basis) |

When using Fixed Amounts for Labor Rates, the result is a flat charge, rather than a Rate. This does not have much relation to Discounting, since the number of hours spent is not evaluated.

When using Hourly Rates for Labor Rates, again, the charge is not actually related to the Cost of Labor, like a Margin. At best the ultimate Margin may vary depending on the actual Cost.

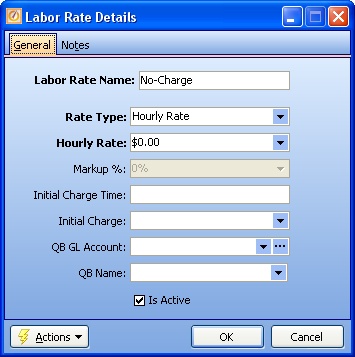

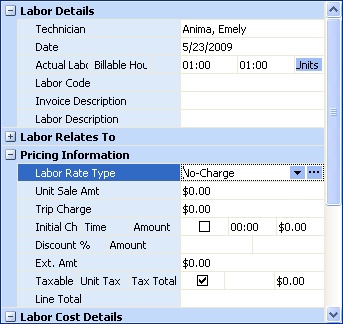

Here is the easiest way to create a No-Charge Price, using a flat Hourly Rate of zero:

Page url: http://www.fieldone.com/startech/help/index.html?_pricing_specialpurpose_discounting_labor_.htm